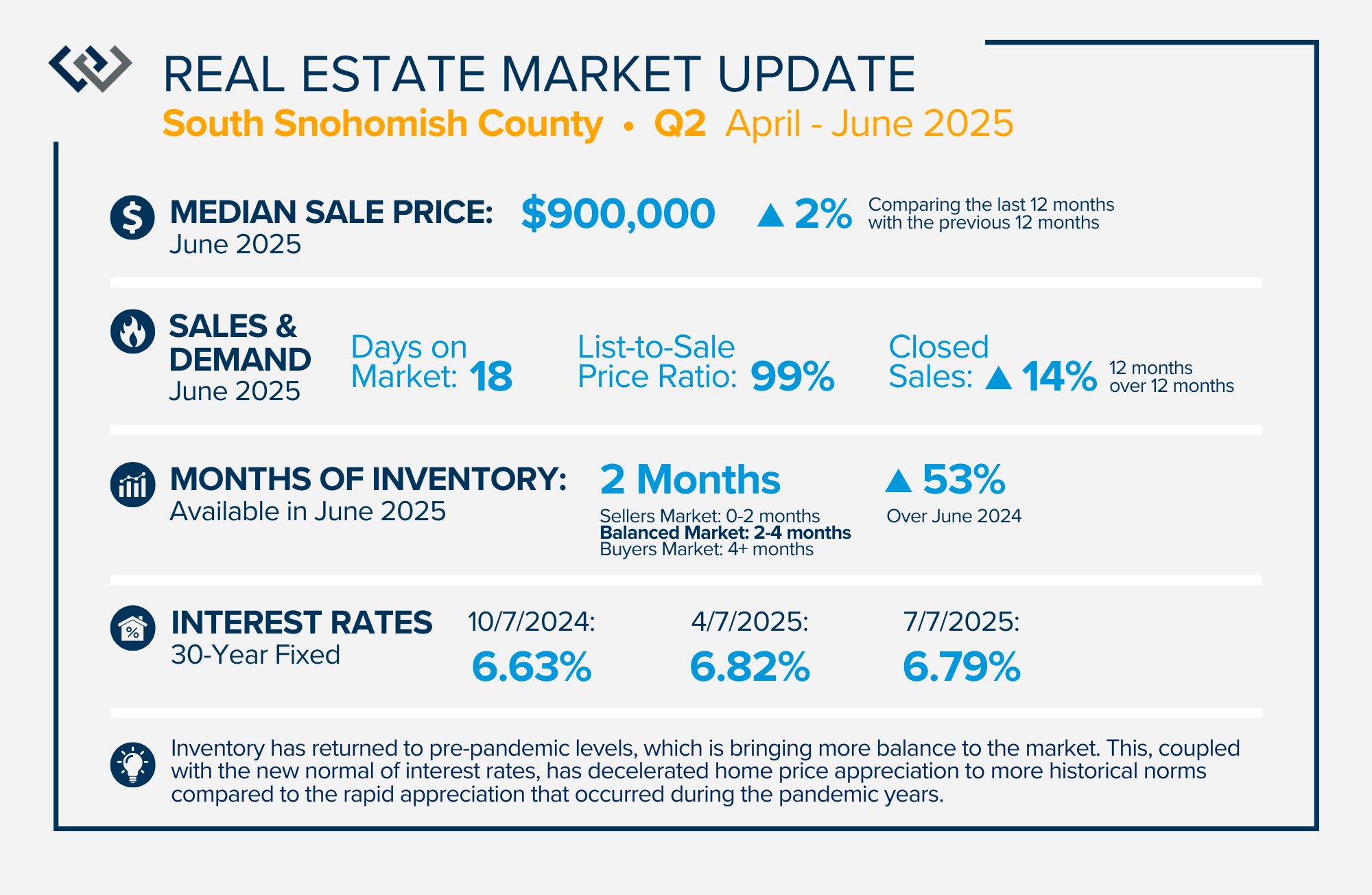

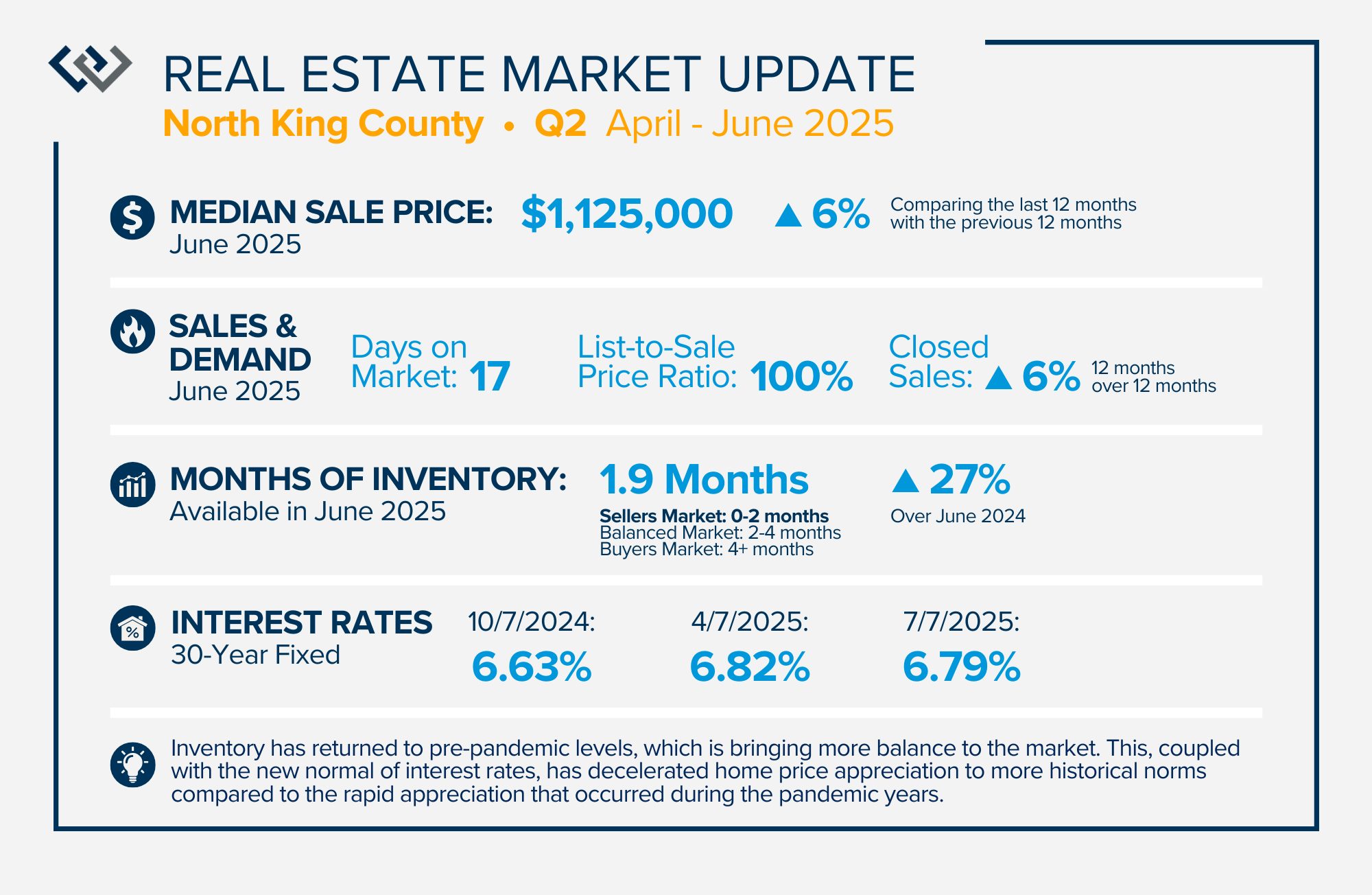

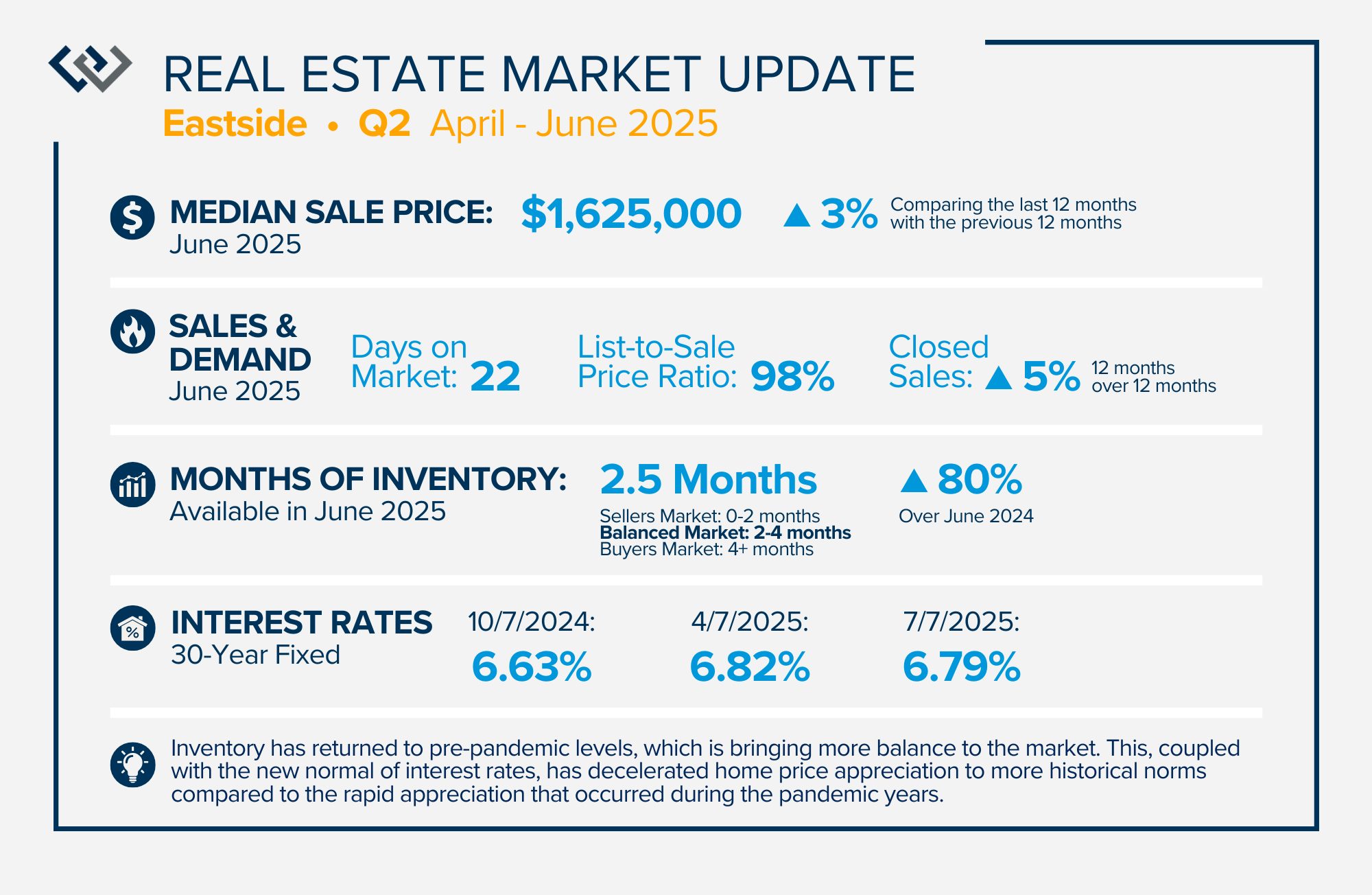

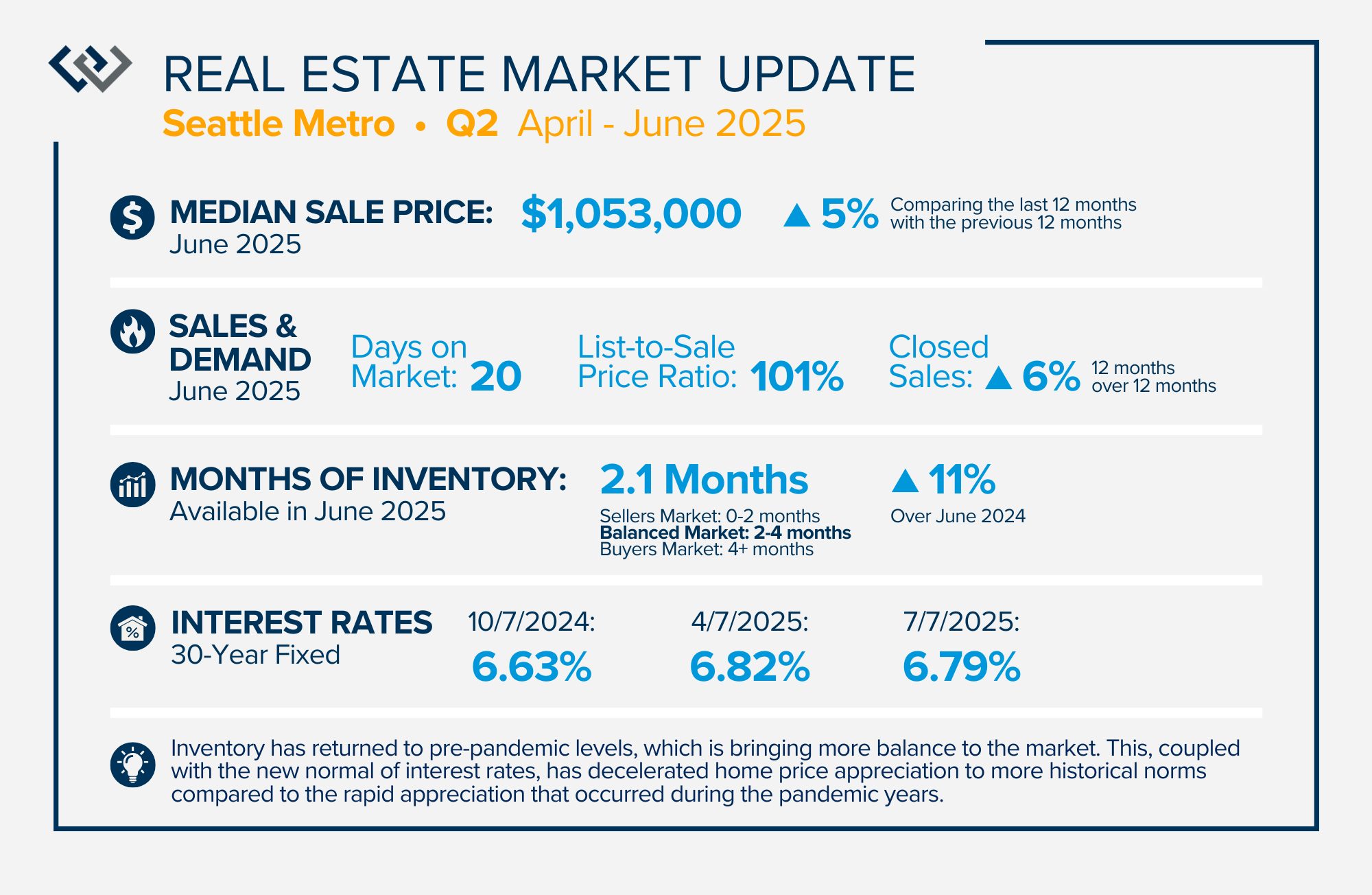

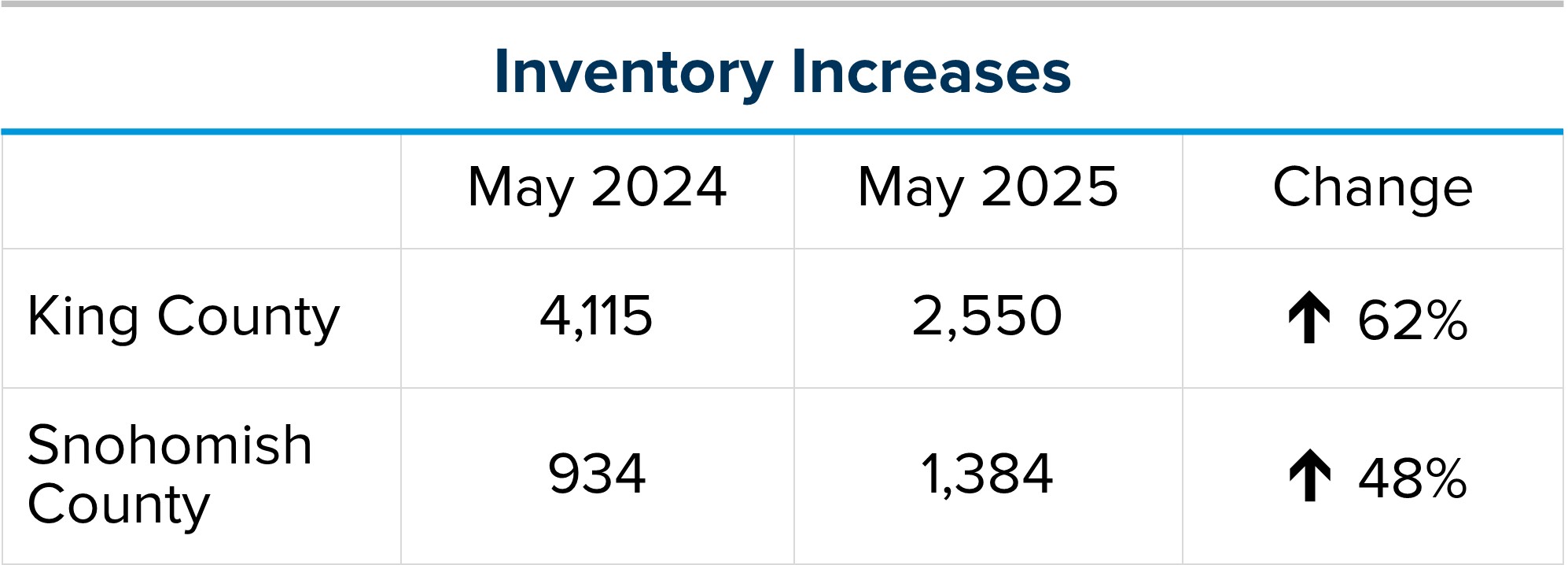

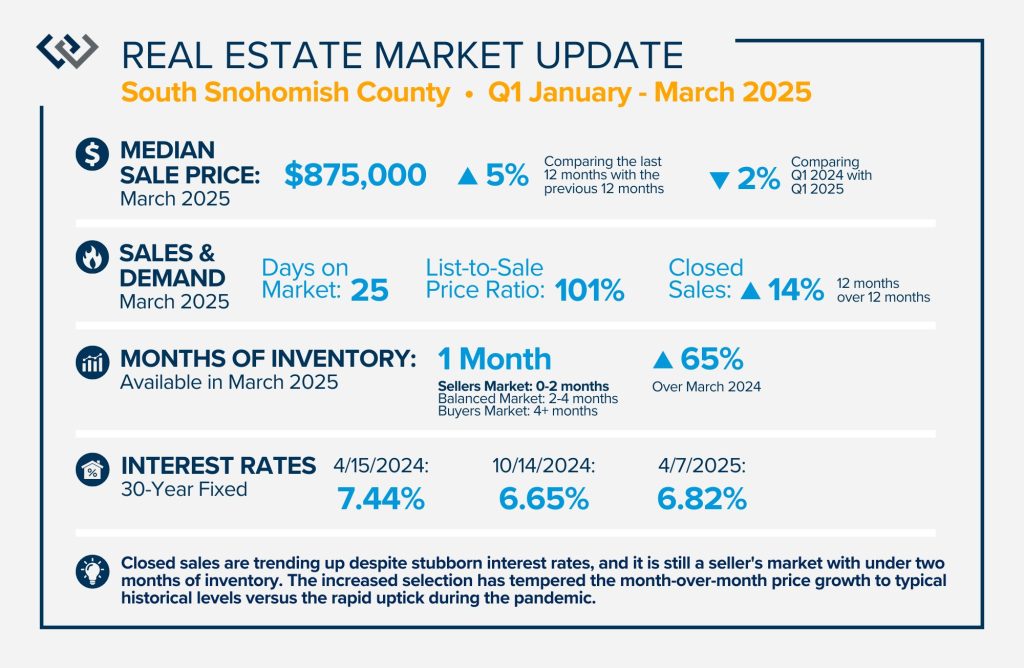

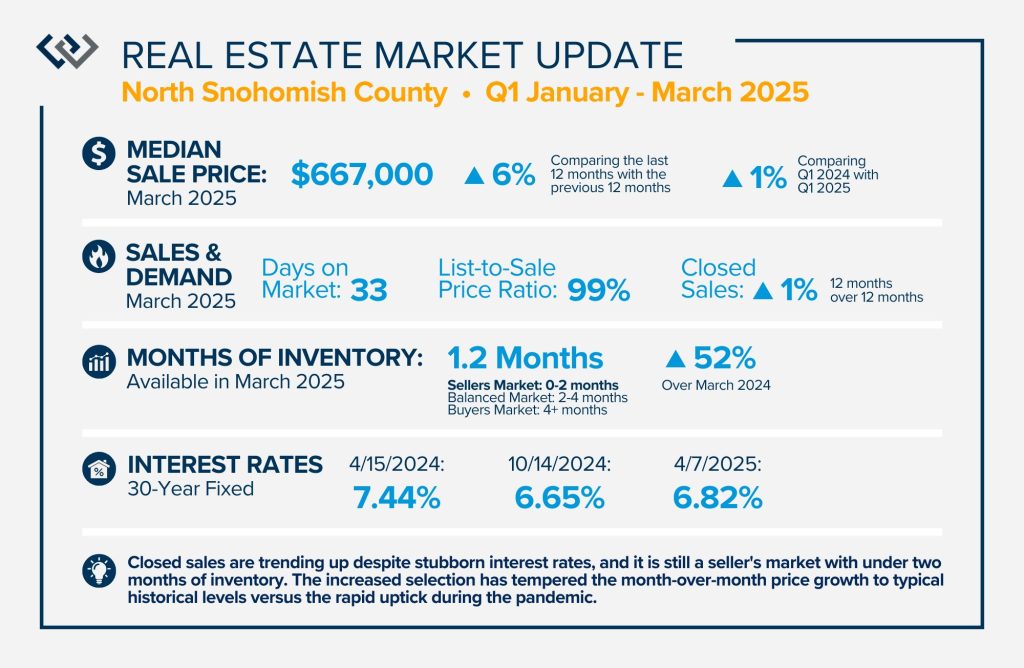

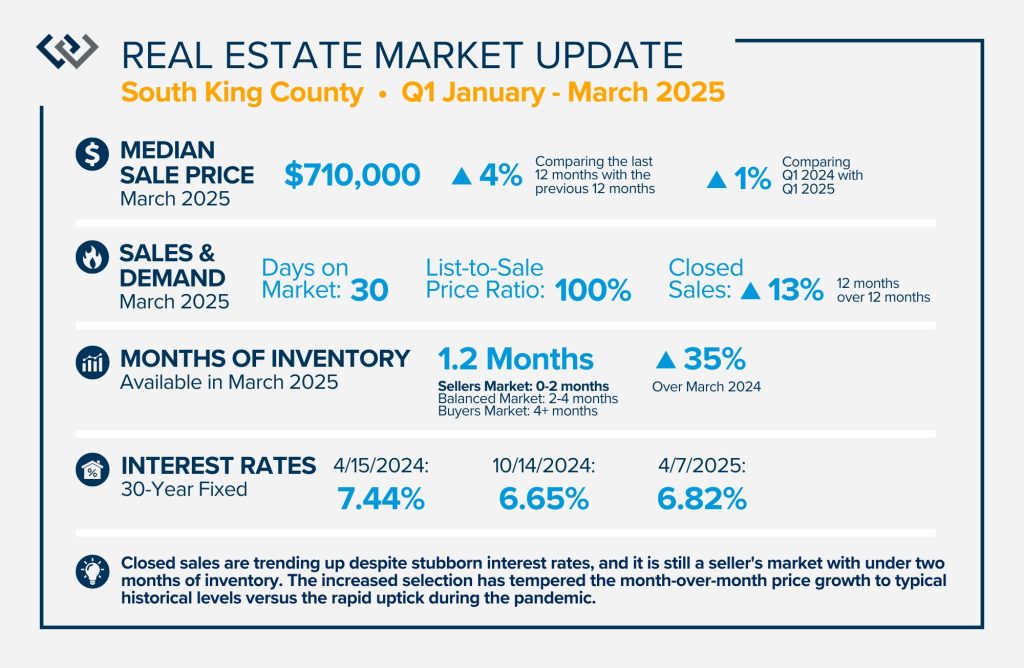

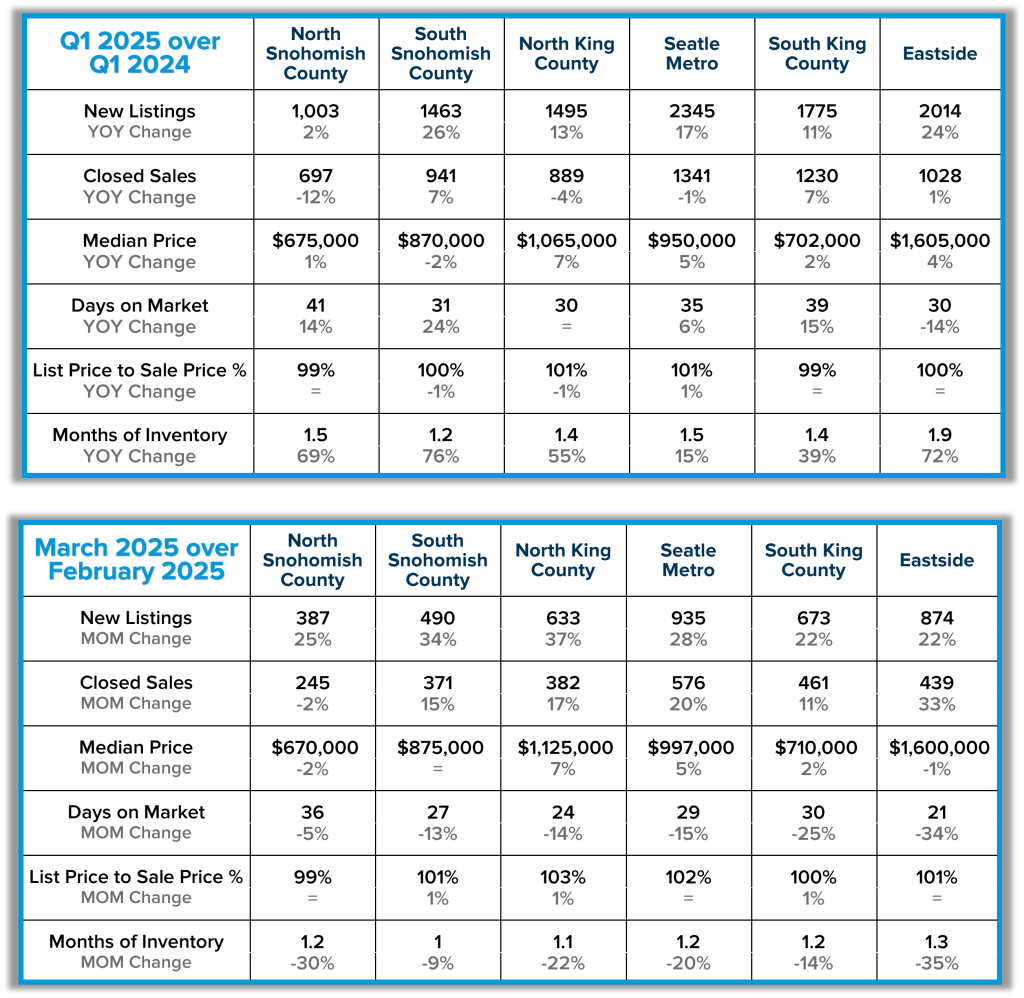

In 2025, we have seen a year-over-year increase in new listings. New listings are up 16% in King County and 10% in Snohomish County, following a 19% increase in King County and an 18% increase in Snohomish County in 2024 compared to 2023. This mounting increase piqued my curiosity, and I began to notice some trends in the inquiries that were coming my way. The trend involved Baby Boomers being on the move!

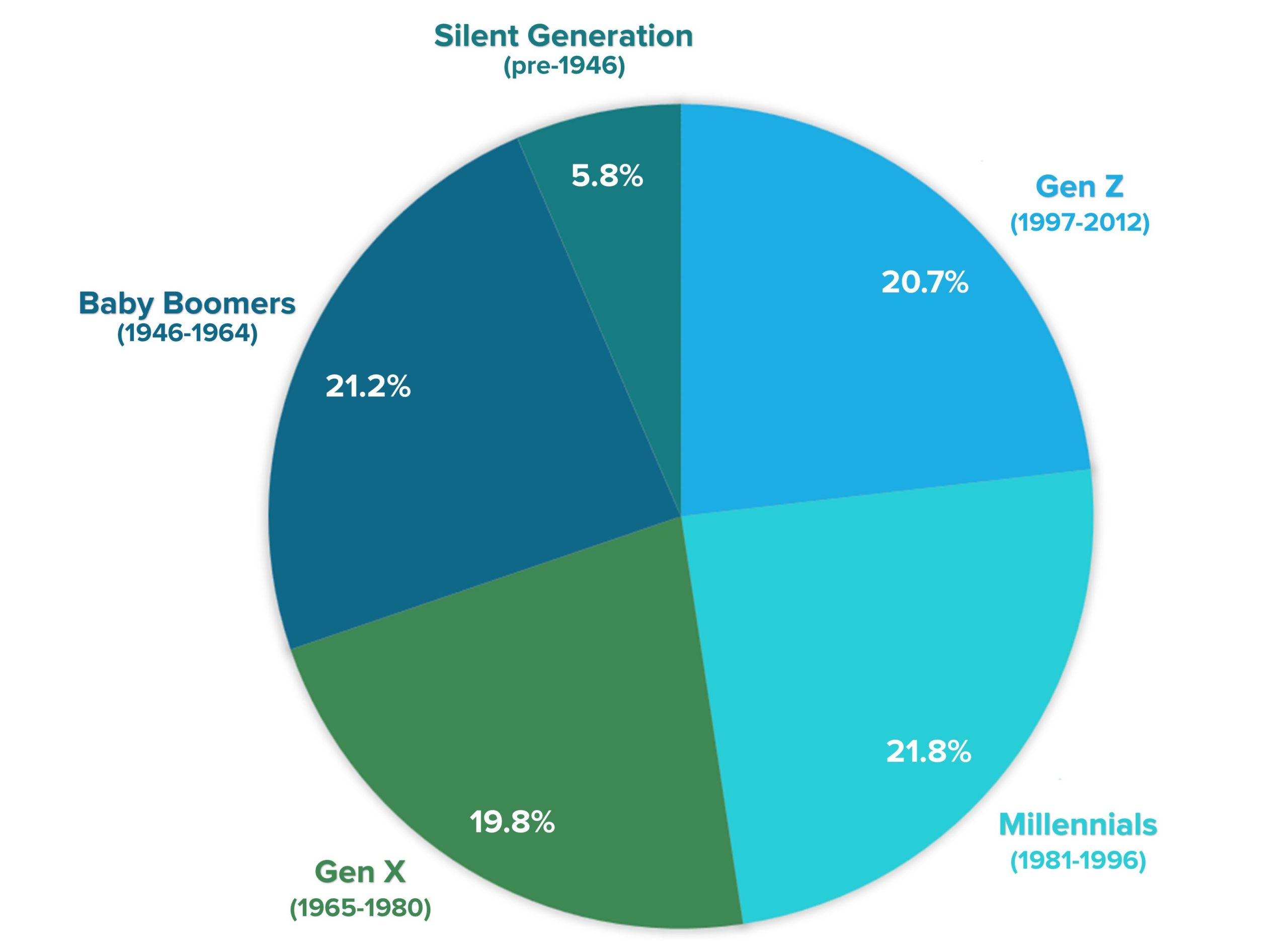

Baby Boomers account for 21% of the US population and are now in their 60s to early 80s. This is a large group navigating major life changes. With fewer encumbrances and responsibilities, many see this as an incredible opportunity to explore their freedom and financial stability. It’s their time! Some are also slowing down, possibly facing challenges, and are seeking comfort and assistance. Many Baby Boomers are moving out of their longtime homes and choosing to reposition either in the same area or out of state. They are buying their dream home that aligns with their lifestyle (think snowbirds), downsizing to a condo or small rambler, moving in with or near family, or relocating to a retirement community, and in some cases, an assisted living facility. The good news is that this generation is sitting on a substantial amount of home equity that is fueling these moves and providing the means to achieve their goals.

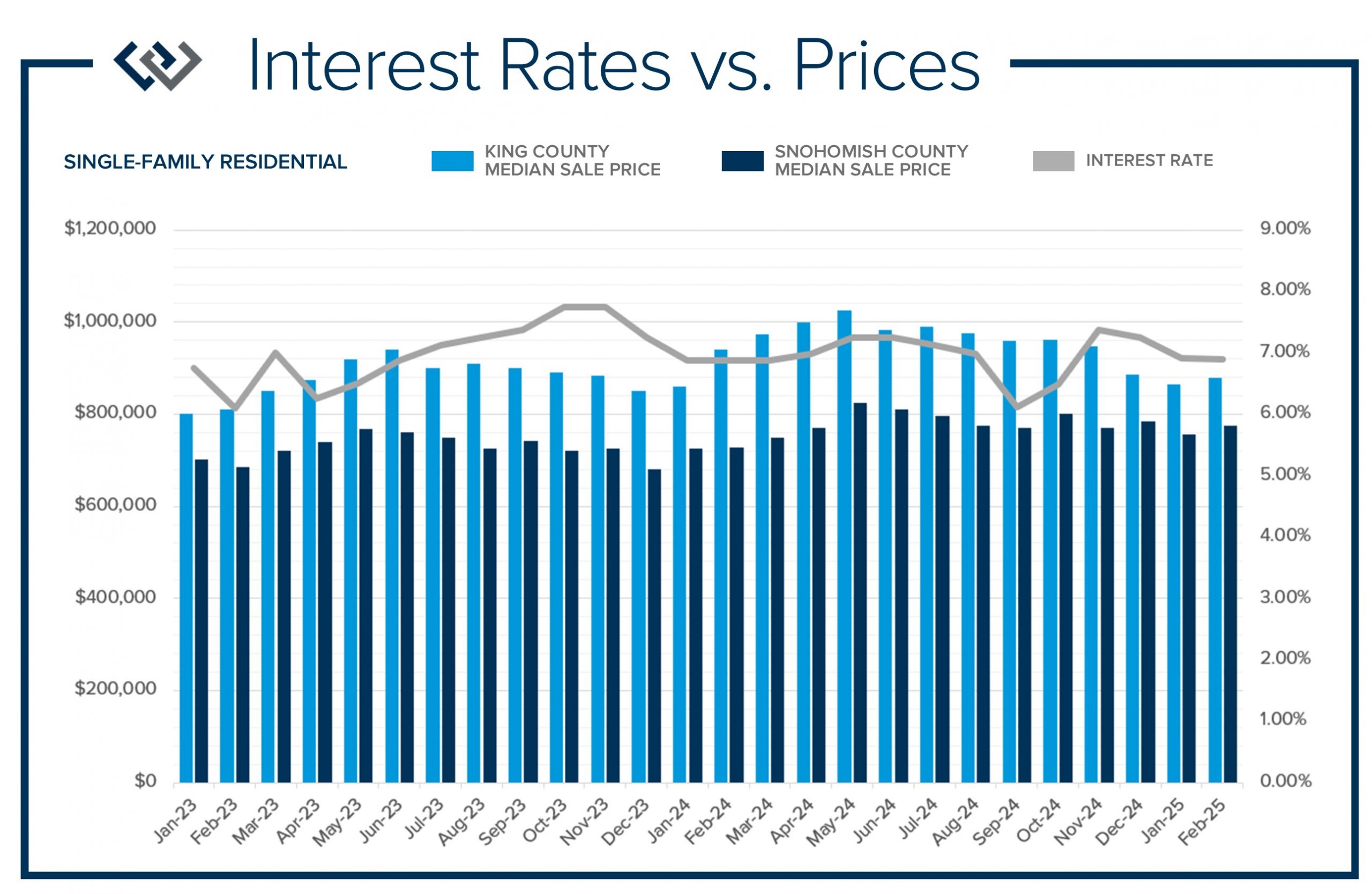

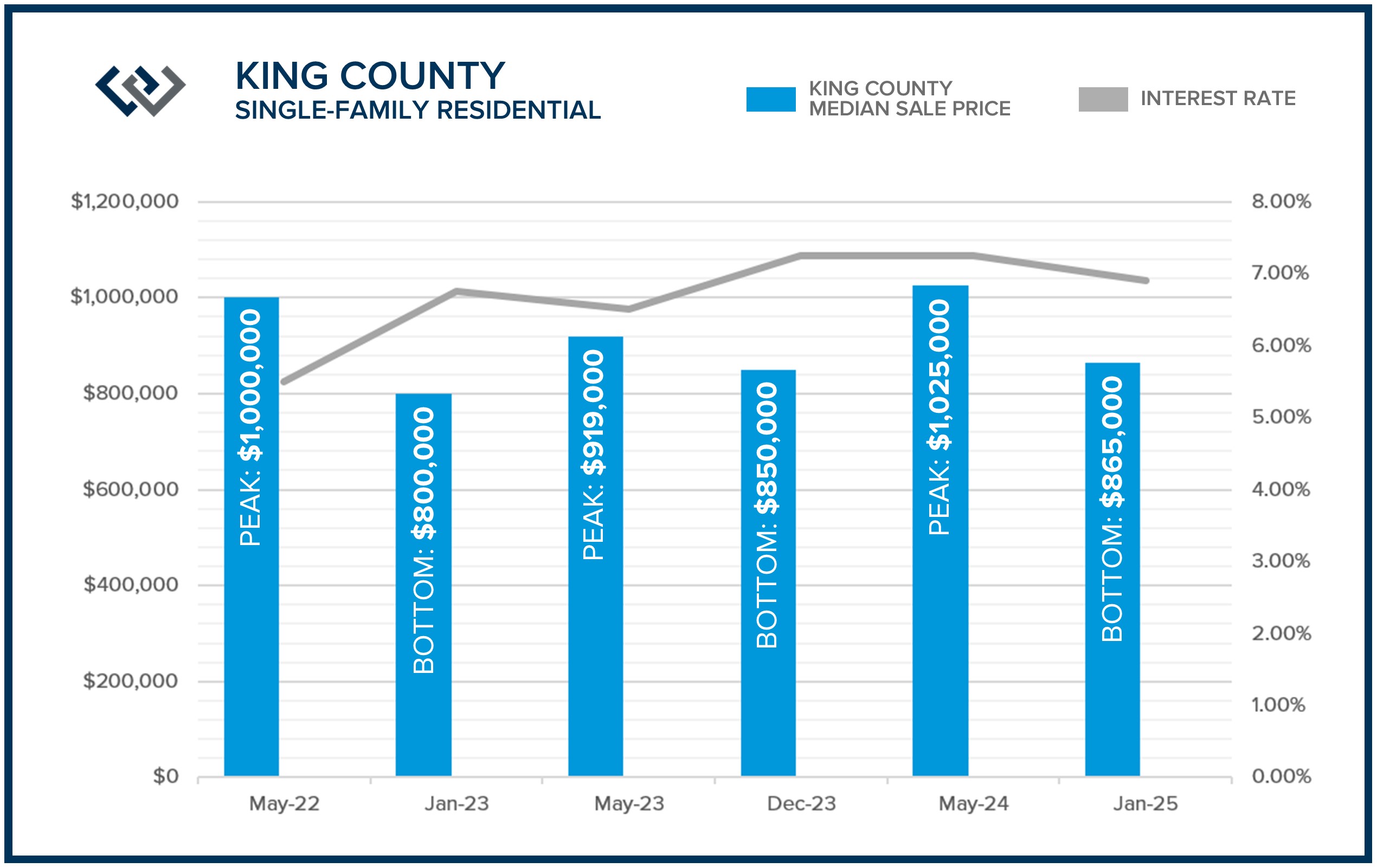

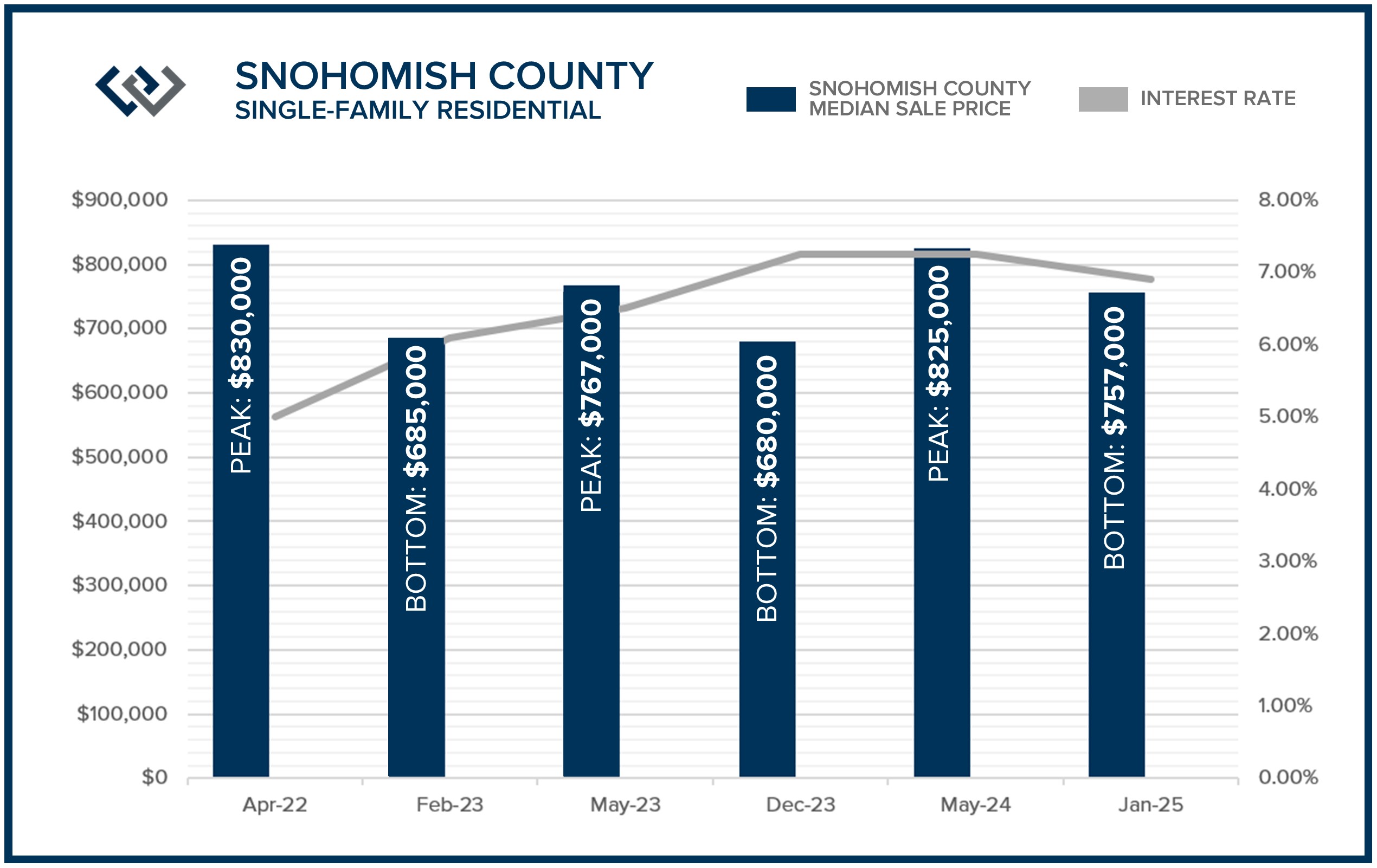

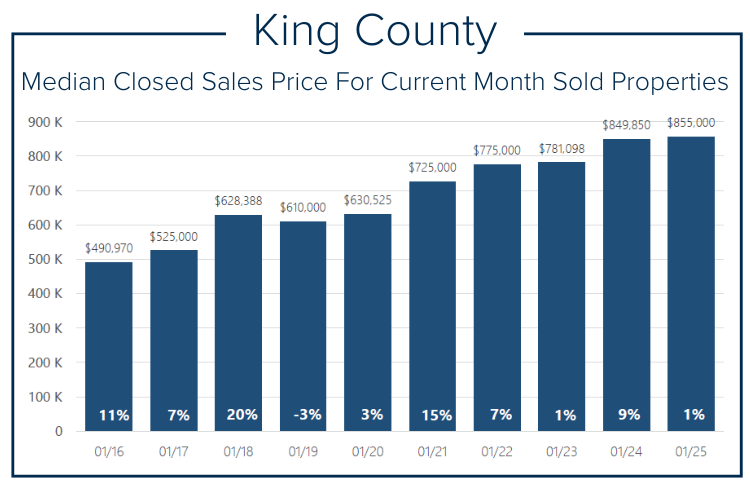

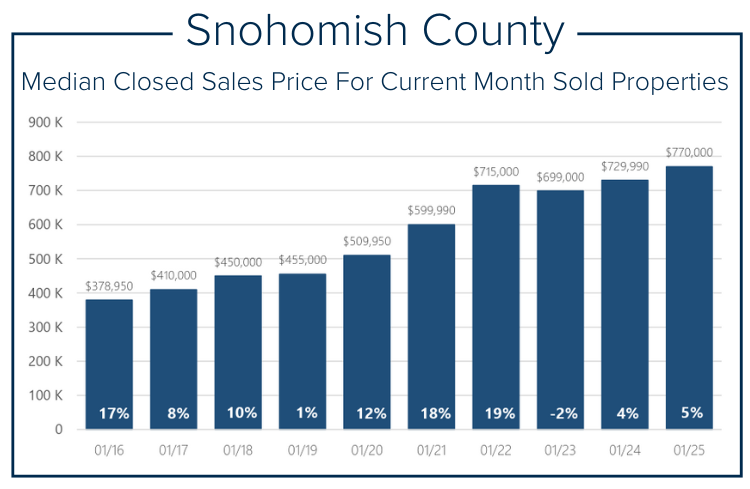

The average Baby Boomer has owned their home for 17-23 years and has 60-80% home equity, and in many cases, owns their home free and clear. In May 2025, the median price for a single-family residential home in King County was $865,000, and $785,000 in Snohomish County. That is a 127% increase in King County over 20 years and 162% increase in Snohomish County. This nest egg is providing Baby Boomers the financial flexibility to move to a place that will bring peace, ease, and enjoyment in their next chapter.

Deciding to sell a longtime home is never just about real estate—it’s about life, legacy, and letting go. For many Baby Boomers, the idea of moving can bring up a flood of emotions, logistical hurdles, and financial questions. As a real estate professional who has worked with many beloved clients in this exact stage of life, I want to offer some guidance—not just as a broker, but as someone who deeply cares about helping people make this transition with grace and confidence. Whether you’re considering a move yourself or you’re supporting a parent or loved one through this decision, here are some of the biggest challenges we see—and some helpful ways to navigate them.

Fearing the Unknown

Change is never easy, especially when it means leaving behind a familiar neighborhood or lifestyle. There’s often a real fear about what the next step looks like.

What helps:

Take your time exploring options. Visit potential new homes or communities before making a decision. Think about what you want out of life: less upkeep, more walkability, or being closer to loved ones. Often, the move brings more peace, not less. It’s the transition that can be stressful and intimidating, but the end result is worth the temporary discomfort.

Letting Go of a Lifetime of Memories

Your home holds decades of family stories. Maybe it’s where you raised your children, loved your pets, celebrated holidays, or shared countless quiet mornings. The thought of saying goodbye can feel overwhelming.

What helps:

Consider reframing the move. You’re not erasing memories—you’re making space for a new chapter. Think of it as passing the home on to a new owner who will love it just as much. Many clients find comfort in creating photo albums or video tours to preserve those meaningful memories.

Facing the Overwhelm of What to Do with Your Stuff

Sorting through years (or decades) of belongings is one of the biggest roadblocks. It’s easy to get stuck when everything feels important.

What helps:

Start small. Focus on one room at a time, and prioritize the items that hold true sentimental value. Enlist a senior move manager or downsizing expert who specializes in this type of transition. Their help can make the process feel more manageable—and far less emotional. I have contacts for professionals who specialize in these services, whether it is sorting and packing or estate sale assistance, I can connect you with trusted service providers.

Managing the Physical Demands and the Time Suck of a Move

Packing and moving can be tough at any age, but especially so for those with mobility issues or health concerns. Furthermore, if you are still working and have a busy schedule, a move can seem out of reach.

What helps:

This is the time to lean on help. There are incredible services available that handle packing, organizing, moving, and even estate sales. Make sure the new space is designed with safety and comfort in mind—single-story homes, walk-in showers, and easy access all make a difference. This move is an opportunity to have your home align with exactly what you need and want to thrive.

Navigating the Financial Piece

Worries about affording a new place—or not getting full value from the home sale—can keep people stuck.

What helps:

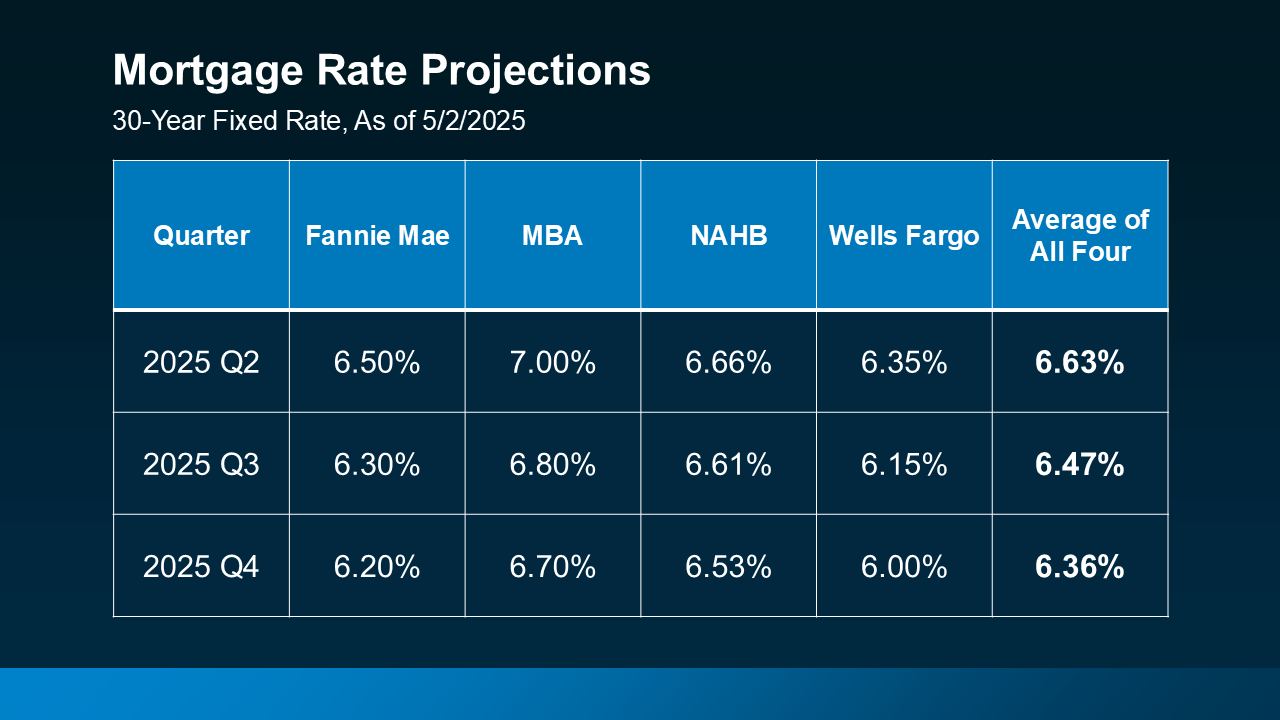

Work with a trusted real estate broker, CPA, and financial advisor who understand your goals, tax code, and the current market trends. Many of my Baby Boomer clients are surprised to learn how much equity they’ve built over the years. That equity can open doors—to a smaller, more manageable home, a lifestyle upgrade, extra savings, or even travel or care options you’ve been dreaming about. Also, if you plan to apply for a mortgage and are approaching retirement, you’ll want to strategize with a reputable lender on whether it makes sense to make your move while you’re still working or after you retire.

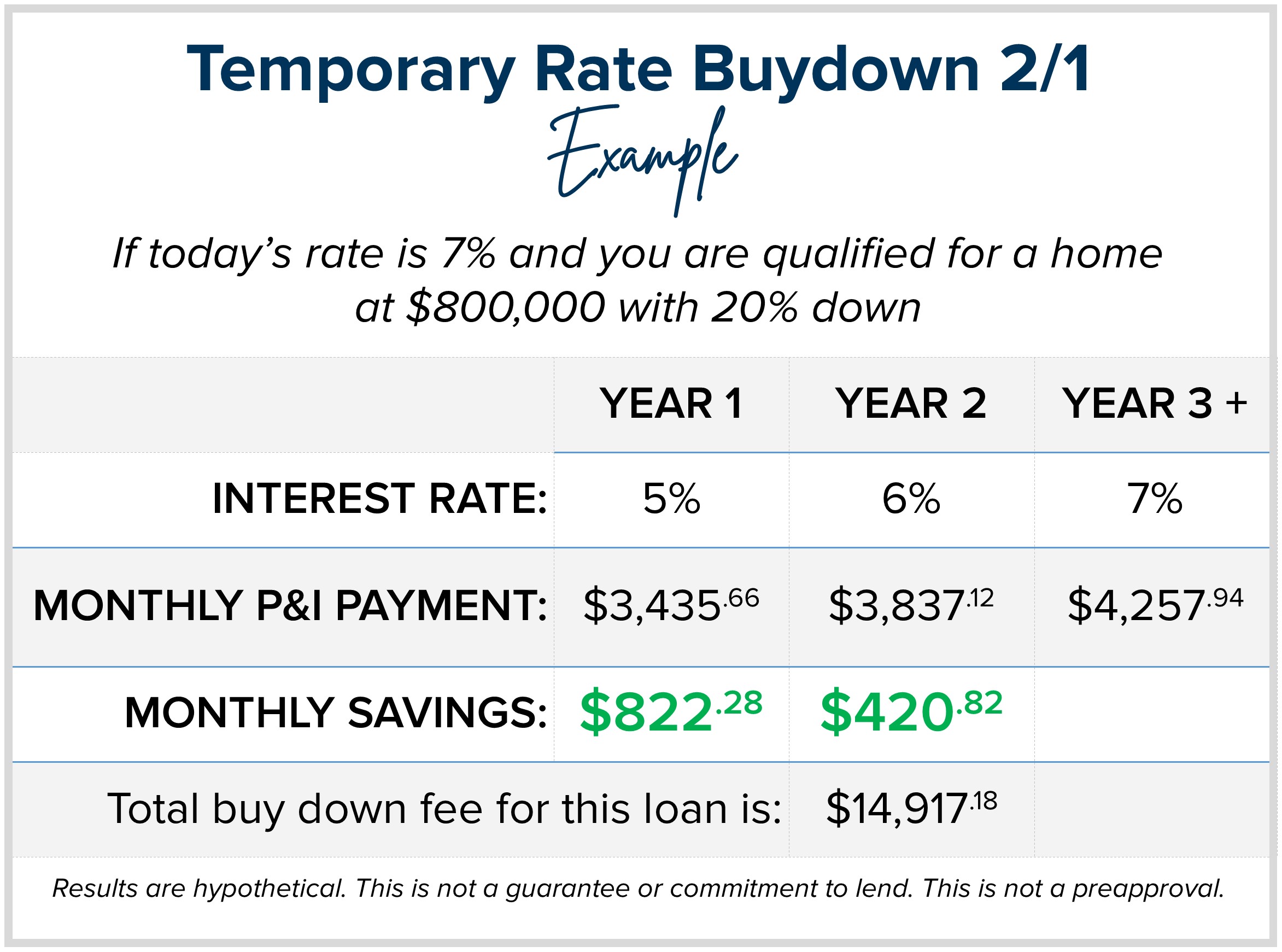

Access to Financing Options for My Next Purchase

Once retired, many Baby Boomers are unsure how to finance their next move, especially if the majority of their cash is tied up in the equity of their current home.

What helps:

Accessing your equity to pay for your next place, so you don’t have to move twice or make a contingent offer. Often, properties that appeal to downsizing Baby Boomers are highly sought after, and home sale contingent offers struggle to compete. Utilizing a bridge loan eliminates the need to be contingent, gives you access to a large amount of your equity, and lets you secure your new place before having to sell your current home. Windermere has an excellent Bridge Loan Program with quick approvals that don’t require an appraisal, and no fees are collected until your home sale is closed, eliminating up-front out-of-pocket expenses.

My House Needs Some Work, and I Don’t Have Access to Money

Maintaining a house requires keeping up with deferred maintenance and making home improvements. These costs can be tough when on a fixed income. Maybe a refresh of a kitchen or bathroom would result in you getting more money for your home when you sell.

What helps:

Have your trusted real estate broker weigh in on your home’s condition and what improvements create the highest return. Windermere also has a loan program called Windermere Ready that allows homeowners to easily access their equity for home maintenance, improvements, and moving expenses. Like the Bridge Loan, the turnaround time is quick, and there are no upfront fees.

Final Thoughts: It’s Okay to Take Your Time

If you’re reading this and feeling a mix of excitement, hope, and some uncertainty—you’re not alone. Selling a long-time home is a major life milestone. But with the right support, it can also be an exciting fresh start.

If you or your loved one are starting to explore this idea, I’m here to talk—without pressure or timelines. My goal is to equip you with tools and guidance to help you feel confident, informed, and cared for, every step of the way.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link